Document validation

Liveness and face matching

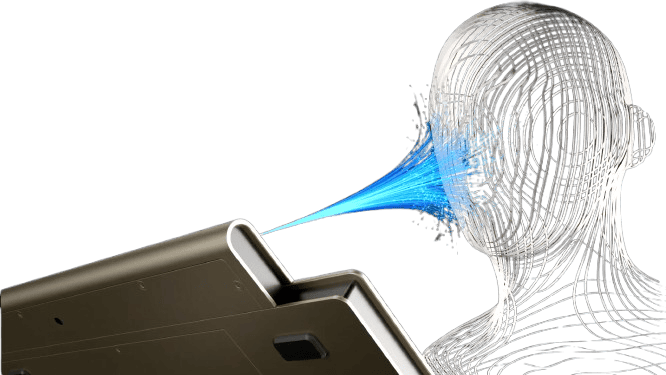

Euronovate Liveness identity verification technology prevents frauds from gaining access to personal accounts and profiles, distinguishing a live person from a static portrait picture of an individual.

The Face matching technology compares a digital image or video frame that contains a human face to stored or captured facial images, establishing whether the face likely belongs to the same person.

Liveness technology

Based on image-processing, face-mapping and motion detection mechanisms, its process assures that the live physical facial presence of a person is validated via facial recognition, at the time of authentication, providing a real-time verification.

ID Verification

User authentication requires real-time processing to validate an individual’s identity to prevent unauthorized access. Liveness technology is one of the main allies against payment fraud, account takeovers, bot attacks, anti-spoofing and much more.

Transactions authentication

Liveness technology prevents biometric spoofing to occur, by incorporating new techniques to analyse beyond the surface of the skin. It guarantees that the process distinguishes between living skin features and replication or copies of those features, executing all the processes in a matter of seconds.

Liveness detection

A robust liveness detection is a must-have technology for digital onboarding or authenticating payments because it easily detects a real person’s presence, and identifies a fake video or screenshot.

Face matching face match onboarding

The proof that a person is real is obtained through facial recognition, an essential requirement to securely finalize different processes in all industries.

Verification is usually carried out using an AI algorithm to compare a customer’s selfie with the photo in the customer’s identity document. The algorithm then determines if there is a match.

Know your customer

The Onboarding process represents the most vulnerable moment when companies risk being a fraud because of the possibility of security flaws during the Know Your Customer (KYC) process. For this reason, being able to successfully verify that someone is who they claim to be, is critical.

AML Anti-Money laundering

Many industries, such as financial services providers. are legally required to enforce Anti-Money laundering (AML) measures in order to provide identification services to reduce the risk of bad transactions.

Payment services directive 2

PSD2, European regulation since 2019 which made two-factor authentication mandatory for a wide range of customer-initiated payments. PSD2 regulation enables customers to easily and securely verify their identity with an image stored by the payment provider to carry out frictionless payments.

Ask for a Demo

Experience our solutions in action. Request a personalised demo to see how we can streamline your workflows, ensure compliance, and deliver measurable business value.