Electronic Signature vs Digital Signature: Key differences explained

Introduction

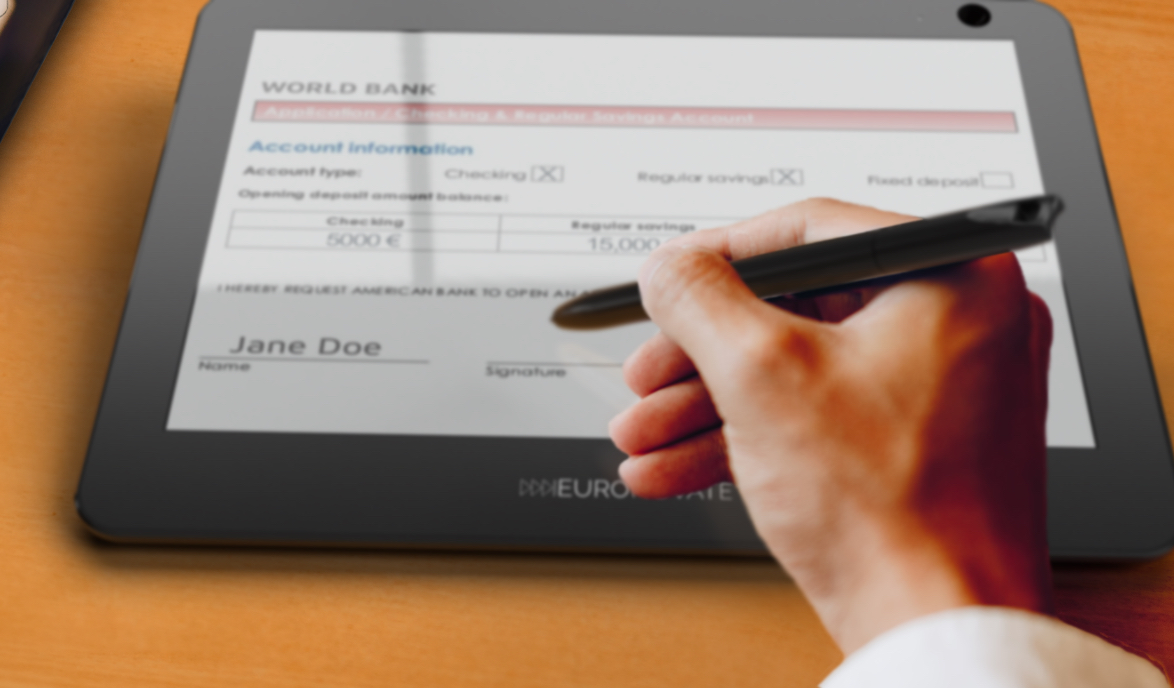

The digital transformation of business processes has made electronic signatures (e-signatures) a key enabler for efficiency, compliance, and customer satisfaction. Whether in banking, healthcare, retail, or the public sector, organisations increasingly rely on electronic signatures to replace traditional paper-based methods.

But what exactly is an electronic signature, and what are the key differences vs a digital signature?

What is an electronic signature?

An electronic signature is a digital method of signing documents that expresses a person’s intent to agree with or approve the contents of an electronic file.

According to the eIDAS regulation (EU Regulation No. 910/2014), there are three main types of electronic signatures:

|

SES |

AES |

QES |

| a basic form, such as ticking a box or attaching a scanned handwritten signature. | linked uniquely to the signer and capable of identifying them, often involving biometric or cryptographic data. | the most secure type, based on a qualified certificate issued by a recognised Trust Service Provider, legally equivalent to a handwritten signature in the EU. |

| No Certificate Needed | Needs a Digital Certificate (with simple ID verification). Obtained via 2FA or MFA | Needs a Qualified Certificate (with rigid ID verification). Obtained from a Qualified Trust Service Provider (QTSP) |

e-signatures are designed for ease of use and speed. They streamline workflows by allowing contracts, forms, and consents to be signed digitally anytime, anywhere.

Examples in real life include:

- Accepting terms & conditions online with wSign

- Signing a retail contract with wDesk

- Patient consent forms in healthcare with or EnSign 11 or EnSign 11 NFC

What is a digital signature?

A digital signature is a cryptographic mechanism that ensures authenticity, integrity, and non-repudiation of electronic data. Unlike e-signatures (which are about user intent), digital signatures guarantee that the content hasn’t been altered and confirm the signer’s identity using certificates and public key infrastructure (PKI).

They are more secure, but often more complex to implement, making them the preferred choice for high-value or regulated transactions (e.g., banking contracts, notarial acts, public administration).

Key differences

Technology

- Electronic Signature: May be as simple as an image, typed text, or biometric capture.

- Digital Signature: Uses PKI, certificates, and encryption to secure the document.

➡️ Euronovate advantage: With EnSoft2 + SoftServer, enterprises can combine biometric e-signatures with qualified digital signatures (QES), ensuring flexibility and compliance at every level.

Security & legal validity

- Electronic signatures (SES, AES, FEA): Legally valid in the EU under eIDAS, especially when biometric data (e.g., pressure, speed, rhythm) is captured via EnSign11 pads.

- Digital signatures (QES): The highest level under eIDAS, legally equivalent to a handwritten signature.

➡️ Euronovate solutions:

- wSign: Supports SES, AES, QES with a full audit trail.

- EnSoft with EnSign 11 SES, AES

- TrustConserve (with Armilis): Ensures long-term, regulatory-compliant archiving of digitally signed documents.

Use Cases

- Electronic signatures:

- Retail: Loyalty program enrolment with EnSign 11 NFC

- Healthcare: Patient consent with EnSign 11 NFC, or EnSoft Mobile

- SMEs: Plug & play signing with wDesk

- Digital signatures:

- Banking: Loan agreements and onboarding with wID + QES

- Insurance: Policy underwriting and claims approval with SoftServer integration

- Public sector: Permits, registries, and tenders archived with EAG & TrustConserve

Why the distinction matters for businesses

Understanding the difference helps organisations choose the right level of assurance:

- For speed, convenience, and customer experience, e-signatures (SES, AES, FEA) are often sufficient.

- For high-stakes, regulated, or legally binding transactions, digital signatures (QES) are essential.

The Euronovate approach

Euronovate bridges both worlds with a complete ecosystem:

- Hardware: EnSign 11 NFC signature pads (biometric + NFC identity capture)

- Software: EnSoft2 (biometric engine), wSign (remote signing), EnSoft Mobile (mobile biometrics)

- Infrastructure: SoftServer + Signing & Compliance Gateways (ECG, EAG, TSG) for vendor independence

- Archiving: TrustConserve for long-term legal validity

By integrating user-friendly e-signatures with secure digital signatures, Euronovate delivers end-to-end trust solutions that are compliant, sustainable, and tailored to industries like banking, healthcare, retail, insurance, and telco.

Share this

You May Also Like

These Related Stories

Why Small Display Signature Pads Risk GDPR Non-Compliance

What is a Graphometric Signature?